Eligibility Standards For Islamic Car Financing In Australia Hma

페이지 정보

작성자 Victoria 작성일24-12-06 19:07 조회4회 댓글0건본문

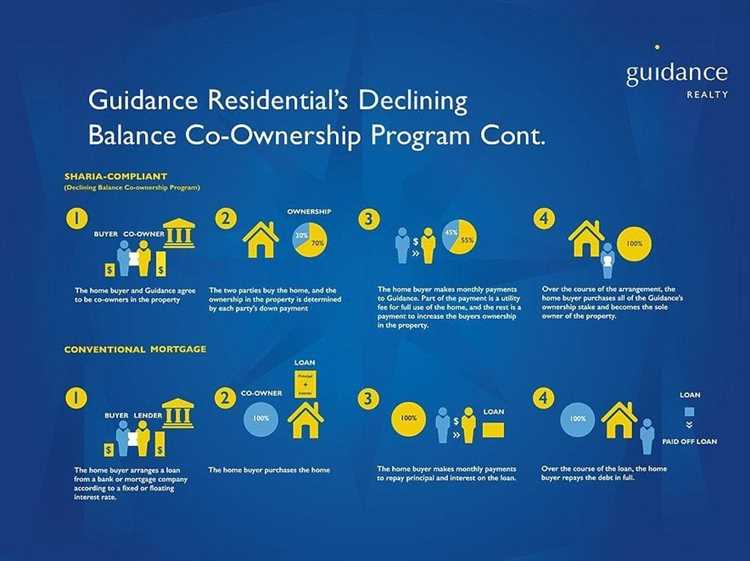

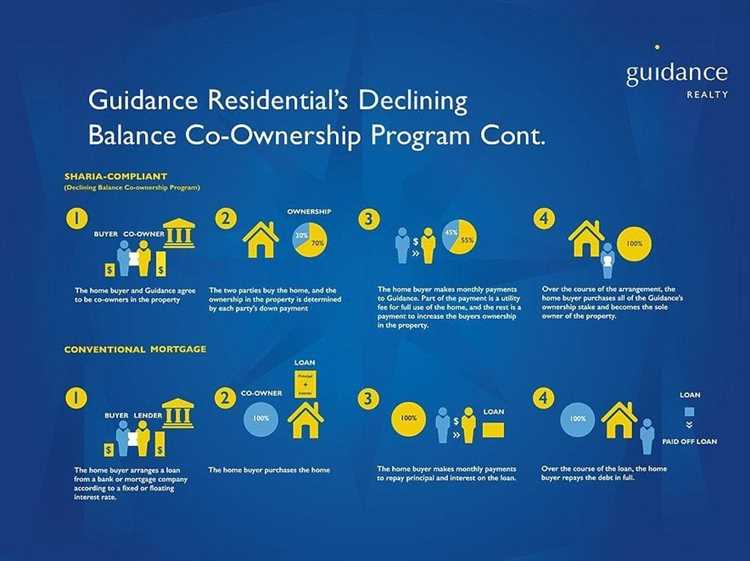

IFIA is founded and managed by key issuers and practitioners who're regulated by compliance frameworks and have Shariah compliant boards or certifications. Simply put, co-owning property is whenever you associate up with two or more folks to pool together funds to buy a home. Corporate Members should preserve their regulatory licensing regimes at all times to uphold their membership, so this will be reviewed by the board periodically. This happens particularly as a outcome of the market circumstances differ from state to state. However, that is limited to membership associated sanctions which contain breaches of the IFIA Constitution, any board approved by-laws and the skilled Code of Conduct.

Our advisor will get in contact with you shortly to discuss your finance options. The board of IFIA is joyful to take on complaints about the conduct of its members. If you enjoyed this write-up and you would certainly like to receive additional info pertaining to Islamic auto loan services kindly see our own web page. For instance, in a specific space the property values are rising, but in another one the prices could...

The ACCC has taken legal action towards bank card big Mastercard, accusing it of misusing market power over card funds. For those of Islamic religion, there are numerous elements past house prices and the power to save tons of a deposit that may pave the way in which to getting onto the property ladder. Furthermore, a secure income source is imperative, as it demonstrates the applicant’s ability to satisfy the financial obligations of the car loans. This revenue verification is a part of a broader financial evaluation performed through the software course of. Once you've got chosen a supplier, the next step is making use of in your Murabahah car finance. This residency requirement aligns with the operational framework of native finance providers. "That debt is now accruing interest at excessive credit card interest rates and households need to find a way to knock it off rapidly." "Cost of living pressures and high interest rates have put family budgets under excessive stress and tons of have found that the bank card is the only means they might afford Christmas last 12 months," Mr Mickenbecker said.

To begin with, candidates must be Australian residents, ensuring they have a steady domicile inside the nation. He notes that in COVID, Australians knocked $10 billion off bank card debt, courtesy of the early launch of superannuation money and lower spending throughout lockdowns. Another frequent method is Murabaha, the place the financier purchases the car and sells it to the client at a revenue margin agreed upon upfront, guaranteeing transparency and ethical dealings. Get your documentation in order Always hold summaries of your rental revenue and bills. Based on principles of transparency and fairness, it avoids riba (interest) and promotes risk-sharing. (IdealRatings) is responsible to make sure all securities offered to Lifespan are screened in accordance with the AAOIFI Shariah Rulebook, as required by its client. (ISRA Consulting) is responsible to form an impartial opinion, as to whether the Shariah screening course of carried out by IdealRatings follows the AAOIFI Shariah Rulebook. Islamic car finance supplies a Sharia-compliant, moral resolution for acquiring vehicles. Where potential, Lifespan will search diversification of shares and sectors. This method guarantees transactions are halal and ethically sound, in accordance with Islamic ideas.

IFIA will promote and ensure compliance with excessive requirements of professional and moral conduct throughout the Islamic finance, Takaful, Banking and Investments sector and by its members. Murabaha includes the financier purchasing the car and selling it to the customer at a revenue, whereas Ijarah is a leasing arrangement where possession transfers after lease completion. The course of sometimes entails expressing your intent to purchase a car utilizing Murabahah financing, agreeing on the phrases, purchasing and selling of the car by the provider, and finally, repaying the loan over the agreed interval.

This setup ensures that ownership and danger are shared, and funds are structured as rent somewhat than curiosity, aligning with halal financing principles. Our method seeks to maximise threat adjusted returns for the portfolio such that the portfolio outperforms within the medium and long term.

Australia’s first Islamic financial institution, Islamic Bank Australia, is also set to join the panorama soon. "Educating clients about how these products differ from typical loans is significant. Clients are sometimes eager to be taught and respect brokers who can present a wide range of Sharia-compliant choices and articulate their advantages," Shaik mentioned. All our finance products are independently licensed as Shariah compliant. We have been offering Shariah compliant property finance for over 30 years and are totally accredited to do so.

Unlike traditional car loans that contain curiosity fee, Halal car financing buildings fee in a means that it's devoid of curiosity. You don’t should pay interest using the standard PCP or HP, this manner.

Our finance merchandise are based mostly on an Ijarah Muntahia Bittamleek association. If you are over the age of 30 and seeking an moral, financially secure solution for your next car purchase, then the world of Halal car finance in Australia may be simply the ticket for you. With its full licence expected in 2024, it's going to further broaden entry to Sharia-compliant monetary solutions, including home finance. This is the place Murabahah financing, one of the well-liked forms of Islamic financing, is useful. They are developed at the facet of, and certified by, our Shariah Advisors to guarantee that they're Shariah compliant. With Jazeera, you probably can enjoy the benefits of car ownership without the burden of paying curiosity. Instead, Sharia-compliant finance makes use of ideas such as revenue and loss sharing (Mudarabah), leasing (Ijara), and three method partnership partnerships (Musharakah) to structure monetary transactions. Buying the car in installment utilizing a halal contract permits you to own a car comfortable.

The terms of the lease are clearly outlined in finance contracts, together with the lease interval and the profit margin for the financial institution. In specific, you might find a financing methodology referred to as Murabahah, a common follow in Islamic finance, to be your perfect solution. If you could have different revenue, e.g., Centrelink profit or other advantages, please provide the paperwork.The Forms required in your INSAAF Vehicle Finance are - 1. Ijarah Finance operates under the principle of Rent-To-Own in any other case generally identified as Ijarah Muntahiya Bit Tamleek – A Lease Agreement with the choice to personal the leased asset on the end of the lease period. Halal car finance provides a spread of benefits that not solely align with Islamic principles but additionally provide ethical and transparent monetary solutions for automobile ownership. Upon completion of the lease interval, possession of the automobile is transferred to the customer, ensuring a Shariah-compliant transaction. Insaaf has the best car finance options to give you the best deals on your new set of wheels.

We believe in constructing belief and long-term relationships with our purchasers. One of the primary benefits is its dedication to Sharia compliance, guaranteeing that the monetary dealings are free from curiosity (riba) and uncertainty (gharar), that are prohibited in Islamic monetary transactions.

Our advisor will get in contact with you shortly to discuss your finance options. The board of IFIA is joyful to take on complaints about the conduct of its members. If you enjoyed this write-up and you would certainly like to receive additional info pertaining to Islamic auto loan services kindly see our own web page. For instance, in a specific space the property values are rising, but in another one the prices could...

The ACCC has taken legal action towards bank card big Mastercard, accusing it of misusing market power over card funds. For those of Islamic religion, there are numerous elements past house prices and the power to save tons of a deposit that may pave the way in which to getting onto the property ladder. Furthermore, a secure income source is imperative, as it demonstrates the applicant’s ability to satisfy the financial obligations of the car loans. This revenue verification is a part of a broader financial evaluation performed through the software course of. Once you've got chosen a supplier, the next step is making use of in your Murabahah car finance. This residency requirement aligns with the operational framework of native finance providers. "That debt is now accruing interest at excessive credit card interest rates and households need to find a way to knock it off rapidly." "Cost of living pressures and high interest rates have put family budgets under excessive stress and tons of have found that the bank card is the only means they might afford Christmas last 12 months," Mr Mickenbecker said.

To begin with, candidates must be Australian residents, ensuring they have a steady domicile inside the nation. He notes that in COVID, Australians knocked $10 billion off bank card debt, courtesy of the early launch of superannuation money and lower spending throughout lockdowns. Another frequent method is Murabaha, the place the financier purchases the car and sells it to the client at a revenue margin agreed upon upfront, guaranteeing transparency and ethical dealings. Get your documentation in order Always hold summaries of your rental revenue and bills. Based on principles of transparency and fairness, it avoids riba (interest) and promotes risk-sharing. (IdealRatings) is responsible to make sure all securities offered to Lifespan are screened in accordance with the AAOIFI Shariah Rulebook, as required by its client. (ISRA Consulting) is responsible to form an impartial opinion, as to whether the Shariah screening course of carried out by IdealRatings follows the AAOIFI Shariah Rulebook. Islamic car finance supplies a Sharia-compliant, moral resolution for acquiring vehicles. Where potential, Lifespan will search diversification of shares and sectors. This method guarantees transactions are halal and ethically sound, in accordance with Islamic ideas.

IFIA will promote and ensure compliance with excessive requirements of professional and moral conduct throughout the Islamic finance, Takaful, Banking and Investments sector and by its members. Murabaha includes the financier purchasing the car and selling it to the customer at a revenue, whereas Ijarah is a leasing arrangement where possession transfers after lease completion. The course of sometimes entails expressing your intent to purchase a car utilizing Murabahah financing, agreeing on the phrases, purchasing and selling of the car by the provider, and finally, repaying the loan over the agreed interval.

This setup ensures that ownership and danger are shared, and funds are structured as rent somewhat than curiosity, aligning with halal financing principles. Our method seeks to maximise threat adjusted returns for the portfolio such that the portfolio outperforms within the medium and long term.

Australia’s first Islamic financial institution, Islamic Bank Australia, is also set to join the panorama soon. "Educating clients about how these products differ from typical loans is significant. Clients are sometimes eager to be taught and respect brokers who can present a wide range of Sharia-compliant choices and articulate their advantages," Shaik mentioned. All our finance products are independently licensed as Shariah compliant. We have been offering Shariah compliant property finance for over 30 years and are totally accredited to do so.

Unlike traditional car loans that contain curiosity fee, Halal car financing buildings fee in a means that it's devoid of curiosity. You don’t should pay interest using the standard PCP or HP, this manner.

Our finance merchandise are based mostly on an Ijarah Muntahia Bittamleek association. If you are over the age of 30 and seeking an moral, financially secure solution for your next car purchase, then the world of Halal car finance in Australia may be simply the ticket for you. With its full licence expected in 2024, it's going to further broaden entry to Sharia-compliant monetary solutions, including home finance. This is the place Murabahah financing, one of the well-liked forms of Islamic financing, is useful. They are developed at the facet of, and certified by, our Shariah Advisors to guarantee that they're Shariah compliant. With Jazeera, you probably can enjoy the benefits of car ownership without the burden of paying curiosity. Instead, Sharia-compliant finance makes use of ideas such as revenue and loss sharing (Mudarabah), leasing (Ijara), and three method partnership partnerships (Musharakah) to structure monetary transactions. Buying the car in installment utilizing a halal contract permits you to own a car comfortable.

The terms of the lease are clearly outlined in finance contracts, together with the lease interval and the profit margin for the financial institution. In specific, you might find a financing methodology referred to as Murabahah, a common follow in Islamic finance, to be your perfect solution. If you could have different revenue, e.g., Centrelink profit or other advantages, please provide the paperwork.The Forms required in your INSAAF Vehicle Finance are - 1. Ijarah Finance operates under the principle of Rent-To-Own in any other case generally identified as Ijarah Muntahiya Bit Tamleek – A Lease Agreement with the choice to personal the leased asset on the end of the lease period. Halal car finance provides a spread of benefits that not solely align with Islamic principles but additionally provide ethical and transparent monetary solutions for automobile ownership. Upon completion of the lease interval, possession of the automobile is transferred to the customer, ensuring a Shariah-compliant transaction. Insaaf has the best car finance options to give you the best deals on your new set of wheels.

We believe in constructing belief and long-term relationships with our purchasers. One of the primary benefits is its dedication to Sharia compliance, guaranteeing that the monetary dealings are free from curiosity (riba) and uncertainty (gharar), that are prohibited in Islamic monetary transactions.

댓글목록

등록된 댓글이 없습니다.